Being in debt is an unpleasant situation to be in, but no longer an uncommon one. Millions of USA citizens face this hassle, and there are certain options you can keep in mind for gaining a few relief earlier than having to record for bankruptcy. One choice you should not forget that you have is

credit card refinancing. There are many businesses that offer this service, and some of those are nonprofit organizations, this means that you may get a few professional recommendation without spending a dime. The counselor will recommend a debt management plan after calculating how much you ought to pay and how much interest to negotiate for with the lenders. The negotiations will allow for month-to-month payments and viable a discount. You can also opt to have the credit recommend employer take money from you and send it to the creditors themselves so no tries are made to hoodwink you.

Another option to not forget is a debt consolidation program. This places all your debts together into one potential account. It`ll help reduce the interest prices on your debt and then you definitely pay a lower monthly payment towards all of your debt. To consolidate your debt, you may get a bank mortgage, a credit score union mortgage or from a from another source. You may also put up your own home as collateral and get a secured mortgage to pay your debts.

Debt agreement was once considered a dubious practice, however, more people are using this option in recent times. To apply this method, you have to use a debt relief enterprise so as to negotiate with creditors on your behalf. the appropriate result would be that you have to pay a part of your debt as a lump sum, whilst the rest of the debt is forgiven. While this from time to time works, your credit rating can be negatively affected. You might have prevented financial disaster, however, the impact to your credit score will be improved within the brief time period.

In case you are feeling confident, you can try and restore your credit and get debt relief on your own, however, achievement isn`t always assured. Keep in mind you may not seek out to deal with the extra fees of hiring a team or a professional to help you. Begin with a plan that has a clear account of your budget and the debt that desires to be made. Show lenders the legitimate documents backing your declare and ask in the event that they could provide you a pardoning of part of your debt by reducing the interest rates or allowing you more time to make repayment. If all else fails, you can offer to pay a portion of your owed debt as a larger lump sum in exchange for excusing the rest of it.

Being in debt is an unpleasant situation to be in, but no longer an uncommon one. Millions of USA citizens face this hassle, and there are certain options you can keep in mind for gaining a few relief earlier than having to record for bankruptcy. One choice you should not forget that you have is credit card refinancing. There are many businesses that offer this service, and some of those are nonprofit organizations, this means that you may get a few professional recommendation without spending a dime. The counselor will recommend a debt management plan after calculating how much you ought to pay and how much interest to negotiate for with the lenders. The negotiations will allow for month-to-month payments and viable a discount. You can also opt to have the credit recommend employer take money from you and send it to the creditors themselves so no tries are made to hoodwink you.

Another option to not forget is a debt consolidation program. This places all your debts together into one potential account. It`ll help reduce the interest prices on your debt and then you definitely pay a lower monthly payment towards all of your debt. To consolidate your debt, you may get a bank mortgage, a credit score union mortgage or from a from another source. You may also put up your own home as collateral and get a secured mortgage to pay your debts.

Debt agreement was once considered a dubious practice, however, more people are using this option in recent times. To apply this method, you have to use a debt relief enterprise so as to negotiate with creditors on your behalf. the appropriate result would be that you have to pay a part of your debt as a lump sum, whilst the rest of the debt is forgiven. While this from time to time works, your credit rating can be negatively affected. You might have prevented financial disaster, however, the impact to your credit score will be improved within the brief time period.

In case you are feeling confident, you can try and restore your credit and get debt relief on your own, however, achievement isn`t always assured. Keep in mind you may not seek out to deal with the extra fees of hiring a team or a professional to help you. Begin with a plan that has a clear account of your budget and the debt that desires to be made. Show lenders the legitimate documents backing your declare and ask in the event that they could provide you a pardoning of part of your debt by reducing the interest rates or allowing you more time to make repayment. If all else fails, you can offer to pay a portion of your owed debt as a larger lump sum in exchange for excusing the rest of it.

Being in debt is an unpleasant situation to be in, but no longer an uncommon one. Millions of USA citizens face this hassle, and there are certain options you can keep in mind for gaining a few relief earlier than having to record for bankruptcy. One choice you should not forget that you have is credit card refinancing. There are many businesses that offer this service, and some of those are nonprofit organizations, this means that you may get a few professional recommendation without spending a dime. The counselor will recommend a debt management plan after calculating how much you ought to pay and how much interest to negotiate for with the lenders. The negotiations will allow for month-to-month payments and viable a discount. You can also opt to have the credit recommend employer take money from you and send it to the creditors themselves so no tries are made to hoodwink you.

Another option to not forget is a debt consolidation program. This places all your debts together into one potential account. It`ll help reduce the interest prices on your debt and then you definitely pay a lower monthly payment towards all of your debt. To consolidate your debt, you may get a bank mortgage, a credit score union mortgage or from a from another source. You may also put up your own home as collateral and get a secured mortgage to pay your debts.

Debt agreement was once considered a dubious practice, however, more people are using this option in recent times. To apply this method, you have to use a debt relief enterprise so as to negotiate with creditors on your behalf. the appropriate result would be that you have to pay a part of your debt as a lump sum, whilst the rest of the debt is forgiven. While this from time to time works, your credit rating can be negatively affected. You might have prevented financial disaster, however, the impact to your credit score will be improved within the brief time period.

In case you are feeling confident, you can try and restore your credit and get debt relief on your own, however, achievement isn`t always assured. Keep in mind you may not seek out to deal with the extra fees of hiring a team or a professional to help you. Begin with a plan that has a clear account of your budget and the debt that desires to be made. Show lenders the legitimate documents backing your declare and ask in the event that they could provide you a pardoning of part of your debt by reducing the interest rates or allowing you more time to make repayment. If all else fails, you can offer to pay a portion of your owed debt as a larger lump sum in exchange for excusing the rest of it.

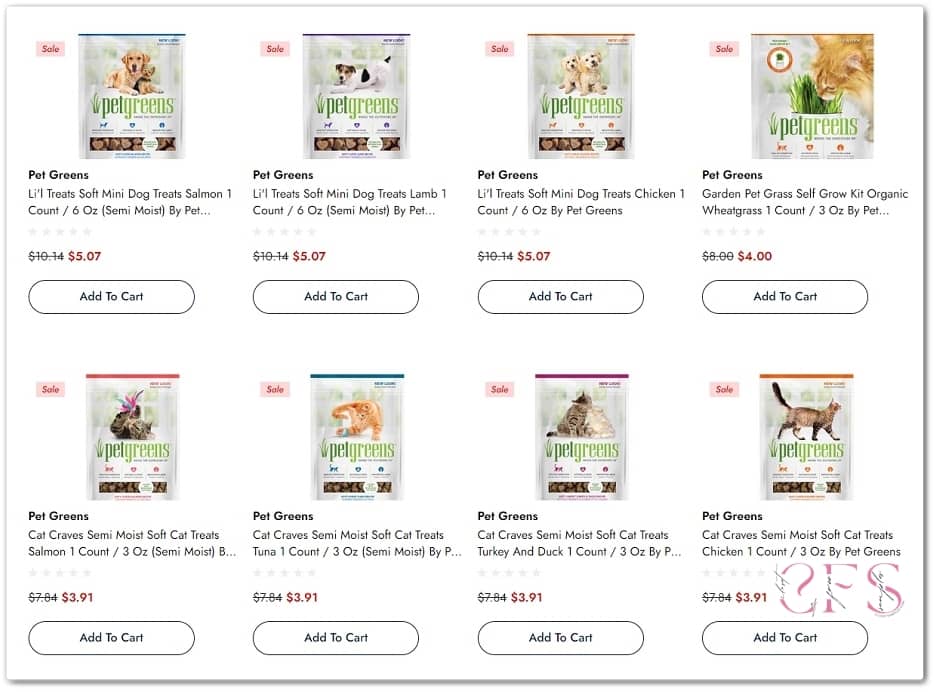

Here you will find all the best coupon advice, tips and how to make the most of all your coupons!

Here you will find all the best coupon advice, tips and how to make the most of all your coupons! Are you looking for ways to stretch your dollar?

Are you looking for ways to stretch your dollar?