Tax season. Just the mention of it can send shivers down even the most financially savvy spine. But what if I told you there was a way to approach tax day with a smile instead of a grimace?

Introducing Smart Tax Strategies, your ultimate guide to transforming tax season from a dreaded chore into a powerful opportunity to maximize your savings and boost your financial future. Imagine having more money in your pocket, not the government's, and feeling confident and empowered knowing you've optimized your finances to the fullest.

Think of it like this: Taxes are an inevitable part of life, but you don't have to be a passive victim. By implementing smart strategies, you can take control of your tax situation and turn it into a springboard for financial success.

In this comprehensive guide, you'll discover:

- Proven strategies to reduce your taxable income, keeping more of your hard-earned money where it belongs.

- Secrets to unlocking the power of tax-advantaged accounts, like IRAs and HSAs, for tax-free growth and future savings.

- Expert tips on claiming every deduction and credit you're entitled to, legally minimizing your tax burden.

- Actionable steps to stay organized and prepared for tax season, ensuring a smooth and stress-free filing process.

So, ditch the tax-time blues and embrace the possibilities of Smart Tax Strategies. With the right knowledge and guidance, you can turn tax season into a triumph, putting more money back in your pocket and paving the way for a brighter financial future.

Ready to unleash the tax-saving power within? Dive into this guide and start reaping the rewards!

Image credit: Freepik

Image credit: Freepik

Understanding Tax Brackets

Think of tax brackets as a series of steps on a financial staircase, each with its own tax rate. As your income climbs, you ascend these steps, encountering different rates at each level. Understanding these brackets is crucial for navigating the complex world of taxes and ultimately

saving money.

Breaking Down the Basics:

Bracket System: The US federal income tax system uses seven tax brackets, with each having a specific tax rate. Your taxable income determines which bracket you fall into, and only the portion of your income that falls within that bracket is taxed at the corresponding rate.

Progressive Taxation: The beauty of the system lies in its progressive nature. This means the tax rate increases as your income climbs. In simpler terms, you pay a lower percentage on your lower income and a higher percentage on your higher income.

Taxable Income: Not all your income is taxed. Deductions and credits reduce your taxable income, effectively moving you down the tax bracket ladder and potentially lowering your tax burden.

Impact on Your Wallet:

Knowing your bracket helps you estimate your tax liability and make informed financial decisions throughout the year. Here's how:

- Targeted Savings: Understanding your bracket allows you to identify and prioritize deductions and credits that can bring you down to a lower bracket, saving you significant amounts.

- Strategic Planning: If you're nearing the next bracket threshold, you can strategically adjust your income or deductions to stay within the current bracket or optimize your position in the next.

- Informed Budgeting: Knowing how much of your income goes towards taxes enables you to budget more effectively and plan for financial goals.

Navigating the Brackets Like a Pro:

Here are some tips to leverage your understanding of tax brackets and maximize your savings:

- Stay Updated: Tax brackets and rates are subject to change, so keep yourself informed about the latest regulations and adjustments.

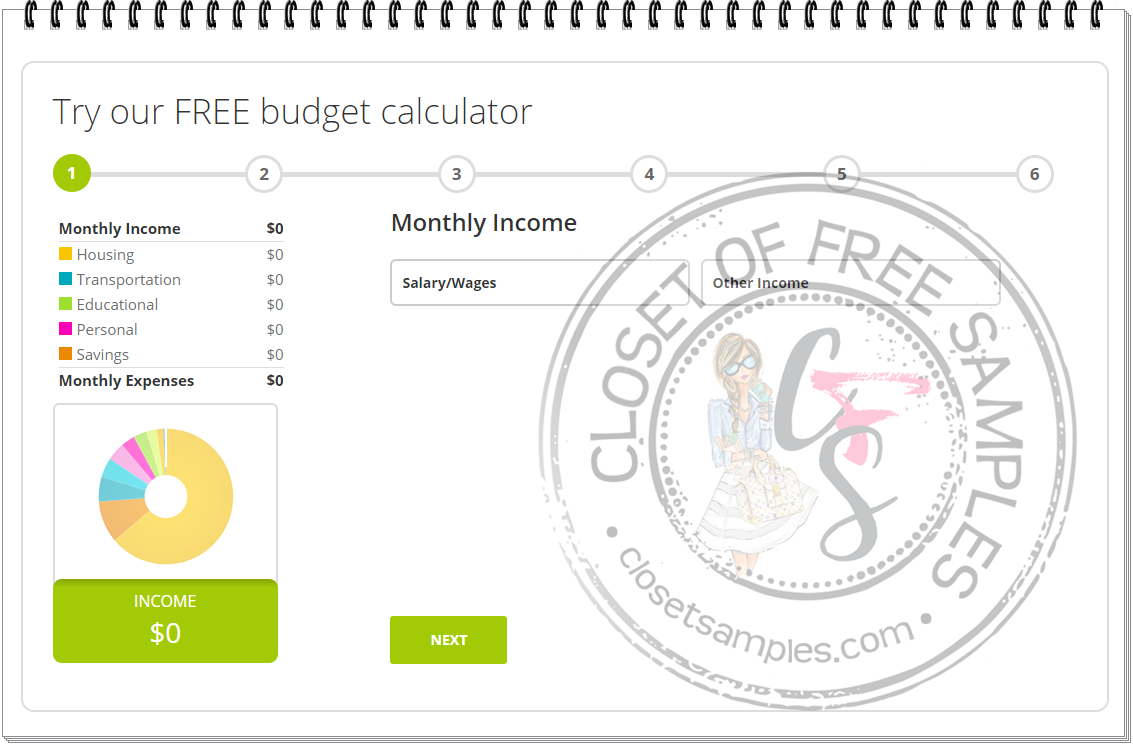

- Utilize Tools: Online tax calculators and software can help you estimate your tax bracket and potential savings based on different scenarios.

- Seek Professional Advice: Consulting a tax professional can provide personalized guidance and ensure you're taking advantage of all available deductions and credits.

Understanding tax brackets is an empowering step towards taking control of your finances and making smarter tax decisions. Remember, knowledge is power, and when it comes to taxes, a little extra insight can go a long way in saving you money and securing your financial future.

PRO TIP:

Image credit: Freepik

Image credit: Freepik

Leveraging Tax Credits

Think of tax credits as financial fuel injectors for your tax return. They directly reduce your tax liability dollar-for-dollar, unlike deductions which only lower your taxable income. This section will be your roadmap to understanding and leveraging different types of tax credits to significantly slash your tax bill and keep more of your hard-earned money in your pocket.

Exploring the Credit Landscape:

Tax credits come in various flavors, each catering to different situations and goals. Here are some popular examples:

- Family and Dependent Credits: The Child Tax Credit offers a credit for each qualifying child, while the Child and Dependent Care Credit can help offset childcare expenses.

- Education Credits: The American Opportunity Tax Credit and Lifetime Learning Credit provide valuable credits for education expenses, making higher education more affordable.

- Savings Incentives: The Saver's Credit rewards low- and moderate-income individuals who contribute to IRAs or retirement accounts.

- Home Improvement Credits: The Residential Energy Credit can help you save on energy-efficient home upgrades, while the Mortgage Credit Certificate Program offers credits for certain homebuyers.

- Employer-Specific Credits: Some employers offer tax credits for specific benefits or programs, so be sure to inquire with your HR department.

Claiming Your Credit Bounty:

Qualifying for and claiming tax credits requires navigating specific criteria and regulations. Here's how to maximize your credit harvest:

- Review Eligibility Requirements: Each credit has its own set of rules, so carefully review the IRS guidelines to ensure you qualify.

- Gather Documentation: Keep meticulous records of receipts, invoices, and other documents to support your credit claims.

- Utilize Tax Software or Consult a Professional: Tax software can automate credit calculations and identify eligible credits, while a tax professional can offer personalized guidance and ensure you claim all available credits.

- Stay Updated: Tax laws and credit regulations can change, so keep yourself informed about the latest updates to avoid missing out on potential benefits.

Remember, tax credits are powerful tools at your disposal. By understanding their diverse forms, diligently meeting eligibility requirements, and claiming them accurately, you can transform them into potent weapons against your tax bill. Embrace the credit bounty and watch your tax liability shrink, leaving you with more financial firepower for your future goals.

Image credit: Freepik

Image credit: Freepik

Deductions and Exemptions

Taxes: the inevitable, often dreaded reality of life. But what if I told you there are hidden loopholes within the tax code, powerful tools called deductions and exemptions that can help you shrink your taxable income and keep more of your hard-earned money? This section equips you with the knowledge to unlock these tax-saving secrets.

Deductions: Your Shopping List for Lower Taxes

Think of deductions as a shopping list for tax savings. Each item on the list, representing specific expenses or categories, allows you to subtract them from your taxable income, effectively lowering your tax bill. Common deductions include:

- Standard Deduction: A pre-determined amount (e.g., $13,850 for single filers in 2024) subtracted from your income directly.

- Itemized Deductions: Individual expenses like mortgage interest, charitable donations, medical expenses, and state and local taxes, which, if exceeding the standard deduction, can be advantageous to claim.

- Business Expenses: If you're self-employed or own a business, expenses like office supplies, travel, and advertising can be deducted.

- Retirement Contributions: Contributions to IRAs and employer-sponsored retirement accounts significantly reduce your taxable income.

Exemptions: The Selective Shield

Unlike deductions, exemptions act like a shield, directly excluding specific portions of your income from taxation. While personal and dependent exemptions were eliminated in 2018, some exemptions still exist, such as:

- Foreign Earned Income Exclusion: Allows certain individuals living and working abroad to exclude a portion of their income from taxes.

- Municipal Bond Interest: The interest earned on certain municipal bonds is exempt from federal income tax (and sometimes state and local taxes too).

- Education Assistance Programs: Funds received for certain qualified education programs may be excluded from income.

Maximizing Your Savings:

Utilizing deductions and exemptions effectively requires thoughtful planning and knowledge of the rules. Here are some tips to get the most out of them:

- Track Your Expenses: Keep meticulous records of receipts and documentation to substantiate your claimed deductions.

- Consult a Tax Professional: A tax professional can help you navigate the complex tax code and ensure you claim all eligible deductions and exemptions.

- Stay Updated: Tax laws and regulations change, so keep yourself informed to avoid missing out on new opportunities or falling victim to outdated information.

Remember, deductions and exemptions are powerful tools in your tax planning arsenal. By understanding their nuances, carefully tracking your expenses, and seeking professional guidance if needed, you can confidently wield them to minimize your taxable income and make tax season a rewarding experience.

Image credit: Freepik

Image credit: Freepik

Investment Strategies

Taxes may be inevitable, but that doesn't mean they have to be the biggest bite out of your investment returns. This section is your passport to the world of tax-efficient investing, where you'll discover strategic maneuvers to minimize your tax burden and maximize your investment growth.

Tax-Advantaged Assets: Your First Line of Defense

Think of tax-advantaged assets as fortresses shielding your investments from the tax storm. These accounts allow you to grow your wealth with significant tax benefits:

Retirement Accounts: IRAs and employer-sponsored plans like 401(k)s offer tax-deferred or tax-free growth depending on the type of account. Contributions are often tax-deductible, and qualified withdrawals in retirement may enjoy further tax advantages.

Health Savings Accounts (HSAs): Contribute pre-tax dollars to cover qualified medical expenses tax-free, and unused funds roll over year-to-year, growing tax-free and becoming accessible for non-medical expenses in retirement.

Municipal Bonds: The interest earned on municipal bonds issued by state and local governments is exempt from federal income tax (and sometimes state and local taxes too).

Series I Savings Bonds: These bonds offer inflation-protected interest rates and federal income tax exemption on the interest if you use the proceeds for education expenses.

Capital Gains Planning: Harvesting Profits Wisely

Selling investments that have gone up in value generates capital gains, and the taxes you pay on those gains depend on how long you held the asset. This is where capital gains planning comes in:

Holding Period Matters: Capital gains are taxed at lower rates if you hold an asset for over one year (long-term). Short-term gains are taxed at your ordinary income tax rate.

Tax-Loss Harvesting: Sell investments at a loss to offset gains realized elsewhere, effectively lowering your taxable income.

Roth Conversions: Consider converting funds from a traditional IRA or 401(k) to a Roth IRA. Taxes are paid upfront, but future withdrawals in retirement are tax-free, potentially advantageous if you expect tax rates to rise in the future.

Beyond the Tools: Strategies for Success

Tax-efficient investing is more than just choosing the right instruments. Here are some additional tips to navigate the landscape:

Diversify Your Portfolio: Don't put all your eggs in one basket. Spreading your investments across different asset classes minimizes risk and offers flexibility for tax planning.

Rebalance Regularly: Periodically adjust your portfolio allocations to maintain your desired asset mix and ensure tax efficiency.

Stay Informed: Tax regulations can change, so keep yourself updated to adapt your strategies accordingly.

Remember, tax-efficient investing is a journey, not a destination. By combining the right assets, strategic capital gains planning, and smart portfolio management, you can navigate the tax complexities with confidence and unlock the full potential of your investments. Seek professional guidance if needed, and remember, the rewards of a well-planned tax strategy can reap significant financial benefits for years to come.

Image credit: Freepik

Image credit: Freepik

Retirement Planning for Tax Savings

Retirement beckons, promising days filled with leisure and freedom. But securing a comfortable retirement goes hand-in-hand with smart financial planning, and one crucial aspect is harnessing the powerful tax advantages of retirement accounts. This section unveils the hidden treasures, helping you transform retirement planning into a tax-saving fiesta.

Tax Haven: The Wonders of Retirement Accounts

Think of retirement accounts as golden fortresses, shielding your savings from the taxman's grasp. Each type offers unique benefits, allowing you to grow your nest egg with significant tax cuts:

- Traditional 401(k)s and IRAs: Contributions are tax-deductible, lowering your current taxable income. Your contributions and earnings grow tax-deferred, meaning taxes are only paid on withdrawals in retirement.

- Roth 401(k)s and IRAs: Contributions are made with after-tax dollars, but the magic lies in tax-free withdrawals in retirement. Your contributions and earnings grow tax-free, compounding and multiplying without the future tax bite.

Choosing Your Champion: Unveiling the Right Account for You

Navigating the retirement account landscape can be confusing, but understanding your goals and circumstances will lead you to the perfect match:

- Early Birds and Tax Savings Seekers: If you're young and starting early, traditional accounts are ideal. The tax deduction lowers your current tax burden, and the tax-deferred growth allows your money to snowball over decades.

- Future Freedom Lovers: For those closer to retirement or expecting higher tax rates later, Roth options shine. Contribute with after-tax dollars now, avoid taxes later, and enjoy tax-free withdrawals to fuel your dream retirement.

- High Earners and Strategic Savers: If your income falls above specific thresholds, Roth options may not be readily available. Consider traditional accounts for current tax deductions and explore alternative tax-advantaged investments like HSAs or Municipal Bonds.

Beyond the Basic Arsenal: Advanced Moves for Max Savings

Remember, retirement planning is a marathon, not a sprint. Here are some advanced strategies to boost your tax-saving power:

- Maximize Contributions: Contribute the maximum allowed to your chosen account – $22,500 for traditional IRAs and 401(k)s in 2023 and $23,000 in 2024, with catch-up provisions for those over 50.

- Catch-Up Contributions: If you're behind on retirement savings, take advantage of catch-up contributions allowed for over-50 individuals, further accelerating your savings growth.

- Diversify Wisely: Don't put all your eggs in one basket. Diversify your investments within your retirement accounts to minimize risk and optimize returns.

- Seek Professional Guidance: A financial advisor can help you navigate the intricate world of retirement planning, choosing the right accounts, and maximizing your tax advantages.

Remember, retirement planning is an investment in your future self. By understanding the power of tax-advantaged retirement accounts, choosing the right one for your circumstances, and employing smart strategies, you can not only build a secure financial future but also enjoy significant tax savings along the way. Let your golden years sparkle with financial freedom, secured through the magic of tax-smart retirement planning.

PRO TIP: Learn !

Image credit: Freepik

Image credit: Freepik

Small Business Considerations

Running a

small business is an exciting endeavor, but the journey comes with its own set of financial intricacies, and taxes hold a prominent place in that landscape. For small business owners, the tax code can seem like a cryptic map, but fear not! This section equips you with the knowledge to navigate the maze and optimize your tax outcomes, turning tax season from a headache into a strategic opportunity to boost your business.

Understanding the Terrain: Key Tax Implications

As a small business owner, you'll encounter a unique set of tax considerations:

Business Type: Choosing the right business structure (sole proprietorship, LLC, S-corporation, etc.) has significant tax implications. Consult a professional to determine the structure that minimizes your tax burden.

Tax Returns: You'll be responsible for filing separate tax returns for your business and yourself. Track your business income and expenses meticulously to ensure accurate reporting.

Self-Employment Taxes: Unlike salaried employees, small business owners are responsible for paying both income and payroll taxes (Social Security and Medicare). Explore deductions and credits to offset these costs.

Deductible Expenses: Many of your business expenses, from office supplies to travel and marketing, can be deducted from your taxable income. Keep detailed records to substantiate your claims.

Specific Incentives: Various tax incentives exist for small businesses, like deductions for research and development or hiring new employees. Research and take advantage of these opportunities.

Charting Your Course: Strategies for Tax Optimization

Beyond understanding the basics, you can proactively implement strategies to minimize your tax bill:

Maximize Deductions: Identify and claim all eligible deductions to reduce your taxable income. Consult a tax professional for guidance on maximizing your deductions.

Utilize Tax-Advantaged Accounts: Explore opening retirement accounts like SEP IRAs or solo 401(k)s to funnel pre-tax income and reduce current tax liability.

Plan for Depreciation: Depreciation allows you to deduct the cost of business assets over their useful life. This can significantly lower your taxable income.

Time Your Expenses: Strategically manage your business expenses throughout the year to optimize their impact on your tax burden.

Seek Professional Advice: Working with a qualified tax advisor can be invaluable. They can help you navigate the complexities of the tax code, identify the most beneficial strategies, and ensure compliance.

Remember, a proactive approach to taxes is key for small business success. By understanding your unique tax landscape, actively seeking deductions and incentives, and employing smart strategies, you can transform tax season from a burden into a powerful tool for financial optimization. Go forth, conquer the tax maze, and watch your business thrive!

Image credit: Freepik

Charitable Contributions

Opening your heart and

helping others through charitable contributions is a commendable act, bringing about positive change for the causes you care about. But did you know that your generosity can also reward you with significant tax benefits, making your good deeds doubly impactful? This section unveils the hidden treasures within charitable contributions, guiding you towards maximizing your tax savings while fueling positive change.

Unveiling the Tax Arsenal: Deductible Donations and Beyond

Think of charitable contributions as powerful missiles against your tax bill. When you donate to qualified charities, you gain access to these tax-saving weapons:

- Itemized Deductions: For those who itemize deductions, charitable contributions can significantly lower your taxable income. Generally, you can deduct up to 60% of your adjusted gross income for cash donations to qualified organizations.

- Standard Deduction Boost: Even if you claim the standard deduction, certain types of charitable contributions, like food donations or volunteering hours, can be claimed above the line, further reducing your taxable income.

- Non-Cash Contributions: Donations of appreciated assets like stocks or property can offer additional tax benefits. You can deduct the fair market value of the asset without recognizing capital gains taxes on the appreciation.

- Qualified Charitable Distributions (QCDs): If you're over 70 1/2 and have a traditional IRA, you can make tax-free withdrawals directly to qualified charities, avoiding income taxes on those funds.

Mastering the Art of Giving: Strategizing for Maximum Savings

While the spirit of giving is paramount, strategic planning can amplify your tax savings:

- Research and Choose Wisely: Ensure your donations go to qualified 501(c)(3) organizations. Maintain proper documentation, like receipts and acknowledgment letters, to substantiate your claims.

- Bunch Together or Spread Evenly: Consider "bunching" your donations every few years to exceed the standard deduction threshold and maximize itemized deductions. Alternatively, you can make regular monthly contributions for consistent tax benefits.

- Utilize Donor-Advised Funds: Donate appreciated assets to a donor-advised fund and receive an immediate tax deduction. You can then distribute the funds to chosen charities over time, allowing for flexible and strategic giving.

- Consult a Tax Professional: Navigating the intricacies of charitable deductions can be complex. Seeking professional guidance can ensure you claim all eligible deductions and optimize your tax benefits.

Remember, charitable contributions are not just about financial transactions; they represent a powerful expression of your values and a commitment to making a positive impact on the world. By understanding the tax advantages and employing intelligent strategies, you can transform your generosity into a double win, benefiting both the causes you care about and your own financial wellbeing. Give with an open heart and a tax-savvy mind, knowing that your contributions are making a meaningful difference on multiple levels.

Image credit: Freepik

Image credit: Freepik

Real Estate Planning

Real estate isn't just about brick and mortar; it's a potential treasure trove of tax benefits waiting to be unlocked. This section delves into the hidden riches of real estate ownership, equipping you with the knowledge to transform your properties into tax-efficient powerhouses and optimize your overall financial picture.

Unveiling the Tax Arsenal: Advantages of Real Estate Ownership

Think of your real estate assets as fortresses shielding you from the tax storm. Here's how investing in property can benefit your tax situation:

- Depreciation Deductions: Buildings and improvements on your property gradually lose value over time. You can deduct this depreciation from your taxable income, effectively lowering your tax bill.

- Mortgage Interest Deduction: The interest you pay on your mortgage loan can be deducted from your taxable income, providing significant savings, especially in the early years of ownership.

- Rental Income and Expenses: If you rent out your property, the rental income is taxable, but you can deduct any expenses related to maintaining and managing the property, further reducing your taxable income.

- 1031 Exchange: The "Sell and Swap" Power Play: This special tax rule allows you to sell a property and reinvest the proceeds in a similar property without recognizing capital gains taxes. Effectively, you "swap" your investment and defer taxes until you eventually sell the replacement property.

Mastering the Art of Real Estate Tax Planning:

Beyond the basic benefits, strategic planning can amplify your tax savings:

- Maximize Depreciation: Understand the different depreciation methods and choose the one that best suits your property and tax situation.

- Track Your Expenses Meticulously: Keeping detailed records of all rental-related expenses is crucial for claiming all eligible deductions.

- Consult a Tax Professional: Navigating the complexities of real estate tax laws can be tricky. A qualified professional can ensure you optimize your deductions, utilize strategies like 1031 exchanges effectively, and stay compliant with regulations.

- Consider Additional Strategies: Explore options like Opportunity Zones for potential tax breaks on investments in certain designated areas, or investigate strategies for minimizing taxes on inherited property.

Remember, real estate can be a powerful tool for building wealth and securing your financial future. By understanding the tax advantages it offers, employing smart planning strategies, and seeking professional guidance when needed, you can transform your properties into tax-efficient assets, boost your overall financial wellbeing, and create a secure and lucrative investment portfolio.

PRO TIP: Also, learn - you can use this to our your tiny home on!

Image credit: Freepik

Tax-Efficient Education Planning

The pursuit of knowledge, whether for oneself or loved ones, often comes with a hefty price tag. But fear not, education-seekers! This section unlocks the hidden magic of tax-efficient education planning, revealing valuable credits, deductions, and savings strategies to help you finance your academic dreams without breaking the bank.

Tax Credits: Your Tuition-Blasting Superweapons

Think of tax credits as cash-back rewards for education expenses. These powerful tools directly reduce your tax liability dollar-for-dollar, effectively lowering your out-of-pocket costs:

- American Opportunity Tax Credit: Offers credit up to $2,500 per year for qualified education expenses for yourself or dependents enrolled in higher education.

- Lifetime Learning Credit: Provides credit up to $2,000 per year for eligible education expenses for undergraduate and graduate studies.

- Saver's Credit: Rewards low- and moderate-income families who contribute to IRAs or retirement accounts, including education-dedicated 529 plans.

- State and Local Tax Credits: Many states offer additional education-related tax credits, so be sure to explore your local options.

Deductions: Minimizing the Tax Bite on Education Costs

While not as potent as credits, deductions allow you to subtract certain education expenses from your taxable income, effectively lowering your overall tax burden:

- Student Loan Interest Deduction: You can deduct up to $2,500 of the interest you pay on qualified student loans per year.

- Tuition and Fees Deduction: If you itemize deductions, you can deduct up to $4,000 in tuition and fees for yourself or dependents enrolled in certain educational programs.

- Educator Expenses: Teachers and other qualified educators can deduct certain classroom expenses like supplies and professional development costs.

Savvy Strategies for Future Scholars: Tax-Advantaged Savings Plans

Planning ahead is key to minimizing the financial strain of education. Utilize these dedicated savings vehicles to grow your education funds with substantial tax benefits:

- 529 Plans: Invest in state-sponsored 529 plans for yourself or loved ones. Contributions may be tax-deductible (depending on your state), and qualified withdrawals for eligible education expenses are tax-free.

- Coverdell Education Savings Accounts (ESAs): Similar to 529 plans, ESAs offer potential tax-deductible contributions and tax-free withdrawals for qualified education expenses.

- Roth IRAs: Although primarily for retirement, Roth IRAs allow penalty-free withdrawals for qualified education expenses, offering another tax-advantaged savings option.

Remember, education is an investment in your future or the future of those you love. By understanding the tax-efficient tools at your disposal, employing smart planning strategies, and seeking professional guidance when needed, you can navigate the financial landscape of education with confidence, ensuring your academic goals are met without sacrificing your financial well-being. Knowledge is power, and using that power to optimize your education expenses will pave the way for a brighter, more fulfilling future.

Image credit: Freepik

Image credit: Freepik

Health Savings Accounts (HSA)

In the often-bewildering realm of healthcare, Health Savings Accounts (HSAs) stand as shining beacons of tax-saving potential. This section empowers you to unlock the magic of HSAs, demystify their advantages, and navigate the world of qualified medical expenses with confidence.

Think of HSAs as potent financial fortresses, shielding you from the tax storm of healthcare costs. They boast a remarkable trifecta of tax benefits:

Pre-Tax Contributions: Contributions to your HSA are deducted from your taxable income, effectively lowering your current tax burden. It's like getting instant savings on every dollar you put in!

Tax-Free Growth: Your HSA funds grow tax-free, allowing your healthcare savings to flourish without the taxman taking a bite. Your money works harder for you, accumulating with greater efficiency.

Tax-Free Withdrawals: When used for qualified medical expenses, like doctor visits, prescriptions, or medical equipment, withdrawals from your HSA are completely tax-free. It's your money, tax-free and ready to shield you from unexpected healthcare costs.

But wait, there's more! HSAs aren't just for immediate expenses. You can also:

- Invest your HSA funds: Grow your savings even further by investing a portion of your HSA in qualified investment options. Remember, consult a financial advisor before making investment decisions.

- Carry over unused funds: Any unused funds in your HSA roll over year after year, building a robust healthcare safety net for the future.

Navigating the Qualified Medical Expense Maze:

Understanding what qualifies as a qualified medical expense is crucial for maximizing your HSA benefits. Here's a handy guide:

- Traditional medical expenses: Doctor visits, hospital stays, surgeries, prescriptions, preventive care, vision and dental care, wheelchairs, and other medical equipment.

- Over-the-counter medications: Certain over-the-counter medications may qualify, but check with your HSA provider or the IRS for specifics.

- Mental health services: Therapy sessions, mental health medications, and substance abuse treatment are all eligible HSA expenses.

- Long-term care insurance premiums: Certain qualified long-term care insurance premiums are eligible HSA expenses.

Remember, HSAs are powerful tools, but using them effectively requires some planning and guidance:

- Consult your HSA provider or the IRS: Always double-check whether an expense qualifies before using your HSA funds.

- Keep detailed records: Maintain meticulous documentation of your medical expenses and HSA transactions for tax purposes.

- Seek professional advice: Consider consulting a tax professional or financial advisor to ensure you're maximizing your HSA benefits and utilizing them in accordance with regulations.

By harnessing the power of HSAs, you can transform your healthcare finances into a tax-efficient haven. Use them strategically, stay informed, and empower yourself to navigate the healthcare landscape with confidence. Let HSAs be your tax-advantaged shield, protecting your wallet and ensuring you're prepared for whatever healthcare costs your future may hold.

Image credit: Freepik

Image credit: Freepik

Keeping Abreast of Tax Law Changes

The world of taxes, like the tides, is constantly in flux. New laws, regulations, and interpretations can emerge seemingly overnight, potentially impacting your hard-earned savings and financial goals. But fear not, tax voyager! This section equips you with the tools and knowledge to stay afloat in the ever-changing sea of tax law, ensuring your strategies remain relevant and your financial future secure.

Why Staying Informed Matters:

Think of tax law changes as hidden currents that can unexpectedly steer your financial course. Staying informed allows you to:

- Maximize Savings: New tax benefits or deductions can emerge, offering opportunities to optimize your tax burden and keep more of your hard-earned money.

- Minimize Penalties: Unawareness of changes can lead to missed deadlines, incorrect filings, or even penalties. Staying updated helps you stay compliant and avoid unnecessary financial setbacks.

- Adapt Strategies: As the tax landscape evolves, your existing strategies may need adjustments to remain effective. Proactive awareness allows you to adapt your approach and maintain optimal tax efficiency.

- Make Informed Decisions: Knowledge is power, especially when it comes to your finances. Staying informed empowers you to make confident decisions about investments, retirement planning, and other financial matters that are impacted by tax changes.

Navigating the Information Ocean:

With so much information out there, staying informed can feel overwhelming. Here are some helpful resources to guide you:

- Official Government Websites: The IRS website and your state's tax agency website are your primary sources for reliable and up-to-date information on tax laws and changes.

- Tax Professionals: Consulting with a qualified tax professional is invaluable, especially for complex situations or personalized guidance. They can help you interpret new regulations and adapt your strategies accordingly.

- News and Publications: Stay informed through reputable financial news sources, tax publications, and professional organizations' newsletters. Choose credible sources known for their accuracy and objectivity.

- Webinars and Seminars: Attending webinars or seminars hosted by tax professionals or financial institutions can be a great way to learn about recent changes and gain insights from experts.

Remember, staying abreast of tax law changes is not a one-time event, but an ongoing process. Develop a routine for checking for updates, whether it's setting calendar reminders, subscribing to newsletters, or dedicating time each month to research relevant changes.

By embracing a proactive approach to staying informed, you can navigate the ever-changing landscape of tax laws with confidence. You'll be empowered to maximize your savings, avoid penalties, make informed decisions, and ultimately secure a financially brighter future.

Image credit: Freepik

Image credit: Freepik

Hiring Professional Help

The intricacies of tax planning can sometimes resemble a labyrinthine maze, leaving even the most determined navigator feeling lost and bewildered. But fear not, weary traveler! This section illuminates the path to professional assistance, showing you the powerful benefits of hiring a tax consultant and equipping you with the tools to select the right professional guide for your financial journey.

Why Seek Professional Help?

Think of tax consultants as knowledgeable cartographers, charting a course through the tax maze and ensuring you reach your financial destination with maximum efficiency. Consider these advantages of hiring a professional:

Expertise and Experience: Tax professionals possess deep understanding of complex tax laws, regulations, and strategies. They can navigate obscure deductions, apply intricate credits, and identify hidden opportunities for tax savings that you might miss on your own.

Time Savings and Peace of Mind: Grappling with tax forms and calculations can be time-consuming and stressful. Professionals take the burden off your shoulders, freeing you to focus on other aspects of your life while knowing your taxes are in capable hands.

Reduced Risk of Errors: Mistakes on tax returns can lead to penalties and audits. Tax professionals minimize this risk by ensuring accuracy and compliance, protecting you from financial repercussions and unwanted stress.

Strategic Planning and Optimization: Professionals can analyze your financial situation, recommend customized strategies for tax minimization, and help you plan for future tax implications, setting you up for long-term financial success.

Choosing the Right Tax Guide: Your Compass to Tax Savvy

Finding the right tax consultant is crucial to unlocking the full potential of professional help. Here are some tips to navigate this selection process:

Identify Your Needs: Consider the complexity of your tax situation, your financial goals, and the specific services you require. Do you need help with personal taxes, business taxes, estate planning, or a combination?

Seek Referrals: Ask friends, family, or trusted financial advisors for recommendations. Professional organizations like the American Institute of Certified Public Accountants (AICPA) can also provide referrals.

Check Credentials and Experience: Choose a qualified professional with relevant certifications and experience in your specific tax needs. Look for memberships in professional organizations or designations like CPA, EA (Enrolled Agent), or CFP® (Certified Financial Planner™).

Schedule Consultations: Meet with potential consultants to discuss your situation and ask questions about their approach, fees, and communication style. Choose someone you feel comfortable with and confident in.

Compare Fees and Services: Consider the scope of services offered, fee structure, and payment options. Ensure you understand the value you're receiving for the cost.

Image credit: Freepik

Finding the right tax professional can be daunting, but here are some resources to help you navigate your search:

Official Sources:

Professional Organizations:

Other Resources:

Word-of-mouth: Ask friends, family, and colleagues for recommendations of tax professionals they trust.

Online reviews: Read online reviews of tax professionals in your area before making a decision.

Chamber of Commerce: Your local Chamber of Commerce may have a list of tax professionals in your area.

Social media: Many tax professionals have active social media profiles where you can learn more about their services and experience.

Remember, hiring a tax professional is an investment in your financial future. By choosing the right guide, you can navigate the tax maze with confidence, maximize your savings, minimize risks, and achieve financial peace of mind.

Image credit: Freepik

Image credit: Freepik

Common Mistakes to Avoid

The path to tax optimization is strewn with hidden pitfalls, waiting to ensnare the unwary. But fear not, financial travelers! This section equips you with the knowledge to identify and avoid common tax mistakes, ensuring your journey towards tax efficiency is smooth and free of unnecessary financial bumps.

Steer Clear of These Tax Missteps:

Procrastination: Putting off your taxes until the last minute can lead to rushed filing, missed deductions and credits, and even costly penalties. Plan early, gather your documents, and file your return well before the deadline.

Miscalculations: Math errors on your tax return can result in underpaid taxes and potential audits. Double-check your calculations, use tax software, or consider professional help to ensure accuracy.

Missing Deductions and Credits: Many valuable deductions and credits go unclaimed simply because people are unaware of them. Research all available deductions and credits relevant to your situation, and claim them to their full potential.

Overlooking Record-Keeping: Messy receipts and disorganized records can become a nightmare during tax season. Keep meticulously organized records of all income, expenses, and tax-related documents throughout the year.

Neglecting Updates: Tax laws and regulations change constantly. Ignoring these changes can lead to missed opportunities or penalties for non-compliance. Stay informed about new laws and updated regulations, and adapt your strategies accordingly.

Failing to File: Not filing your taxes at all is the ultimate pitfall, leading to significant penalties and interest charges. Even if you owe taxes, file your return on time and explore payment options to avoid further complications.

DIY Misadventures: While DIY tax filing can be tempting, some situations require professional guidance. Trying to navigate complex tax issues on your own can lead to costly mistakes. Seek professional help for intricate tax scenarios, estate planning, or business filings.

Falling for Scams: Be wary of tax scams promising quick refunds or unrealistic deductions. Verify the legitimacy of tax professionals and resources, and avoid sharing sensitive financial information with dubious entities.

Embracing Proactive Steps:

Avoiding these pitfalls takes more than just awareness. Implement these strategies for smooth tax sailing:

- Organize your finances early: Keep a dedicated system for receipts, invoices, and other tax-related documents throughout the year.

- Utilize tax software: Consider using reliable tax software that guides you through the filing process, helps identify deductions, and minimizes errors.

- Schedule regular reviews: Consult a tax professional periodically to review your financial situation and tax strategies, ensuring you stay on track and adapt to changing regulations.

- Ask questions and seek clarification: Don't hesitate to reach out to the IRS or seek professional advice if you encounter any ambiguity or uncertainty regarding tax rules or your specific situation.

Remember, navigating the tax landscape doesn't have to be a stressful endeavor. By understanding common mistakes, actively avoiding them, and embracing proactive strategies, you can transform tax season from a dreaded foe into a manageable ally, enabling you to maximize your savings and achieve financial peace of mind.

Image credit: Freepik

Image credit: Freepik

Conclusion

Tax season often conjures images of stress, confusion, and mountains of paperwork. But armed with the knowledge and strategies explored in this article, you can transform tax day from a dreaded foe into a celebration of financial savvy.

Remember, taxes are not just a yearly obligation; they are opportunity pathways to optimize your finances, claim your rightfully earned benefits, and build a secure financial future. By utilizing the practical tools and insights presented here, you can:

- Maximize your savings: Uncover hidden deductions, leverage valuable credits, and implement smart planning techniques to keep more of your hard-earned income.

- Minimize risks and penalties: Navigate the tax landscape with confidence, avoiding costly mistakes and ensuring compliance with regulations.

- Empower yourself with knowledge: Stay informed about evolving tax laws and adapt your strategies to maximize your benefits.

- Seek professional guidance when needed: Don't hesitate to tap into the expertise of tax professionals to tackle complex situations and optimize your tax outcomes.

With these steps in hand, you can approach tax day not with fear, but with confidence and clarity. You are equipped to chart your own course through the tax maze, emerge victorious with maximum savings, and claim your rightful share of financial freedom. So, let go of the dread, embrace the power of knowledge, and conquer tax day with the smart strategies you've learned today!

Remember, tax planning is an ongoing journey, not a one-time event. Stay vigilant, keep learning, and celebrate your victories along the way. By embracing your financial responsibility with knowledge and proactive strategies, you can transform tax day from a burden to a powerful tool for building a brighter, more secure financial future.

Image credit: Freepik

Image credit: Freepik

FAQs:

Are tax credits the same as deductions?

Tax credits directly reduce the amount of taxes owed, while deductions reduce taxable income. Both contribute to lowering the overall tax liability.

Can small businesses benefit from tax incentives?

Yes, small businesses can qualify for various tax incentives, including deductions for business expenses and credits for specific activities.

How often should I review my tax strategies?

It's advisable to review your tax strategies annually and whenever significant life or financial changes occur.

What is a 1031 exchange, and how does it work?

A 1031 exchange allows for the deferral of capital gains taxes on the sale of certain types of property when reinvesting the proceeds in a similar property.

Is hiring a tax consultant necessary for individuals?

While not mandatory, a tax consultant can provide valuable insights and expertise, especially for individuals with complex financial situations.

Image credit: Freepik

Image credit: Freepik  Image credit: Freepik

Image credit: Freepik  Image credit: Freepik

Image credit: Freepik  Image credit: Freepik

Image credit: Freepik  Image credit: Freepik

Image credit: Freepik  Image credit: Freepik

Image credit: Freepik

Image credit: Freepik

Image credit: Freepik

Image credit: Freepik

Image credit: Freepik Image credit: Freepik

Image credit: Freepik Image credit: Freepik

Image credit: Freepik

Image credit: Freepik

Image credit: Freepik Image credit: Freepik

Image credit: Freepik Image credit: Freepik

Image credit: Freepik

Here you will find all the best coupon advice, tips and how to make the most of all your coupons!

Here you will find all the best coupon advice, tips and how to make the most of all your coupons! Are you looking for ways to stretch your dollar?

Are you looking for ways to stretch your dollar?