The first step to starting your own investment portfolio is simply getting involved. Most people I know do not actively invest in the stock market. They wait for something to happen and allow outside sources to control their future success or failure.

The first thing you need to understand is that you cannot buy a stock and expect it to increase its

stock price targets and value over time. That's what most people think, but I'm here to tell you that it does work like that! There are many different strategies and opportunities out there, such as buying mutual funds (we'll get into that more later), IPOs (Initial Public Offerings), bonds, etc.

I am not an investment advisor or broker, so I can't tell you what stock to buy. There are many great apps and sites available to help with your search, but please take the time to learn more about companies before even considering investing.

You shouldn't just blindly go out and invest in something without fully understanding it. Investing is gambling when you rush into it haphazardly. Do some research on different stocks using commonly known tools like Google Finance or Yahoo Finance, talk to friends who may know people involved in business or economics, or read books about investments. Once you start your quest for knowledge, it will be much easier to find good stocks that are worth investing in.

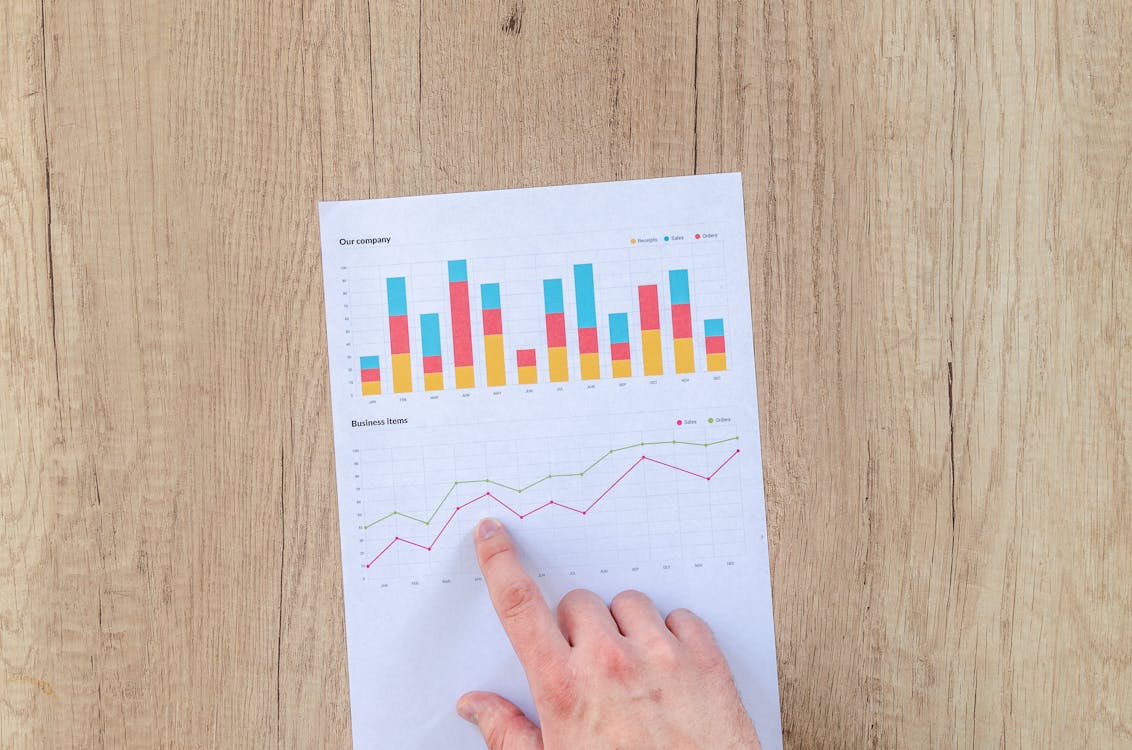

However, if you're not willing to take the time to do proper research before getting involved with the stock market (which I understand because some people don't like reading), then I suggest using index funds. These funds are generally very low risk and often earn better returns than most mutual funds over long periods of time. Be aware that there is always SOME type of risk involved with investing in anything, but limiting your options down to just a couple of different companies or products that have shown good results over time will drastically reduce the number of risks you expose yourself to. Just keep this one simple rule in mind: diversify.

If you're looking for a good place to start, then look into stocks that are contained within the

S&P 500. This is an index fund that contains about 80% of all publicly-traded companies in the U.S., so you will not go wrong by investing there. But again, you should do some research before committing your money because this fund can be very volatile at times.

It is very important to diversify your investments. If you only invest in one stock, then it will be very difficult for you to recover if that company does poorly or gets bought out by another firm. It's just like putting all of your eggs into one basket and then dropping the basket. Splat!

So let's say you can't afford to buy stocks right now, even with index funds. There are still steps you can take to help yourself grow in this market.

- Open a brokerage account and save money in it. Even $100 per month added up over the years will add up and give you a nice beginning for when you feel ready to invest more actively.

- Whenever you receive an extra check or some money, automatically save part of it in your brokerage account. It won't even feel like it's gone.

- Investing doesn't have to be done with the money. You can also invest using time and effort by learning more about the financial world. The Internet is a great tool for research on almost any subject that interests you. Use this knowledge to teach others what you learn so they can take advantage of the opportunities out there, too.

- Lastly, don't ever think that just because someone says something is easy means it IS easy. There are no get-rich-quick schemes out there; everything takes hard work and dedication to achieve a goal. It is much better to achieve a goal slowly than to give up after your first attempt at it.

The Bottom Line

All you need to know right now is getting involved with the stock market requires three simple things: education, patience, and money. If you have all of those, then you are ready to be a part of the only financial market that is open seven days a week, 24 hours a day.

Here you will find all the best coupon advice, tips and how to make the most of all your coupons!

Here you will find all the best coupon advice, tips and how to make the most of all your coupons! Are you looking for ways to stretch your dollar?

Are you looking for ways to stretch your dollar?